All Categories

Featured

Table of Contents

There is no payout if the plan runs out before your death or you live past the policy term. You might be able to restore a term policy at expiration, but the premiums will certainly be recalculated based on your age at the time of renewal.

At age 50, the costs would rise to $67 a month. Term Life Insurance Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and women in exceptional health and wellness.

The reduced risk is one aspect that allows insurers to bill reduced premiums. Rate of interest, the financials of the insurer, and state laws can additionally impact premiums. Generally, firms typically use far better prices at the "breakpoint" coverage levels of $100,000, $250,000, $500,000, and $1,000,000. When you think about the amount of protection you can obtain for your costs bucks, term life insurance policy tends to be the least pricey life insurance policy.

He purchases a 10-year, $500,000 term life insurance coverage plan with a premium of $50 per month. If George passes away within the 10-year term, the policy will certainly pay George's beneficiary $500,000.

If George is detected with a terminal health problem throughout the first plan term, he most likely will not be eligible to restore the plan when it ends. Some policies use guaranteed re-insurability (without evidence of insurability), but such features come with a greater cost. There are several sorts of term life insurance policy.

Normally, the majority of firms use terms ranging from 10 to 30 years, although a few deal 35- and 40-year terms. Level-premium insurance has a fixed monthly repayment for the life of the plan. Most term life insurance policy has a level costs, and it's the kind we have actually been referring to in the majority of this short article.

Reputable Term 100 Life Insurance

Term life insurance policy is eye-catching to youths with kids. Parents can obtain significant insurance coverage for an affordable, and if the insured passes away while the policy is in effect, the household can count on the survivor benefit to replace lost revenue. These policies are likewise appropriate for individuals with expanding family members.

The ideal choice for you will certainly rely on your demands. Right here are some things to think about. Term life plans are suitable for people that want considerable coverage at a low expense. Individuals that own whole life insurance policy pay a lot more in costs for less coverage but have the safety of knowing they are secured forever.

The conversion rider should allow you to convert to any irreversible plan the insurance provider uses without limitations. The primary functions of the biker are keeping the original health and wellness ranking of the term plan upon conversion (also if you later have wellness problems or become uninsurable) and determining when and just how much of the insurance coverage to transform.

Of training course, general costs will boost substantially because entire life insurance policy is more pricey than term life insurance. The benefit is the ensured authorization without a medical examination. Clinical conditions that develop throughout the term life period can not cause premiums to be boosted. Nonetheless, the firm might require limited or complete underwriting if you wish to include added bikers to the new policy, such as a lasting care biker.

Term life insurance is a fairly inexpensive way to give a round figure to your dependents if something takes place to you. It can be a good option if you are young and healthy and balanced and sustain a family members. Entire life insurance policy features substantially greater month-to-month costs. It is indicated to give insurance coverage for as long as you live.

Value Term Life Insurance With Accelerated Death Benefit

It relies on their age. Insurance policy companies established a maximum age restriction for term life insurance policy policies. This is normally 80 to 90 years old however might be greater or reduced depending upon the company. The costs also rises with age, so a person aged 60 or 70 will pay significantly greater than a person years younger.

Term life is rather comparable to automobile insurance policy. It's statistically not likely that you'll need it, and the costs are money down the tubes if you don't. If the worst happens, your family will receive the advantages.

One of the most prominent kind is currently 20-year term. The majority of companies will certainly not market term insurance to an applicant for a term that ends past his/her 80th birthday. If a policy is "eco-friendly," that means it proceeds effective for an added term or terms, up to a defined age, even if the wellness of the insured (or various other factors) would create him or her to be rejected if she or he got a new life insurance policy plan.

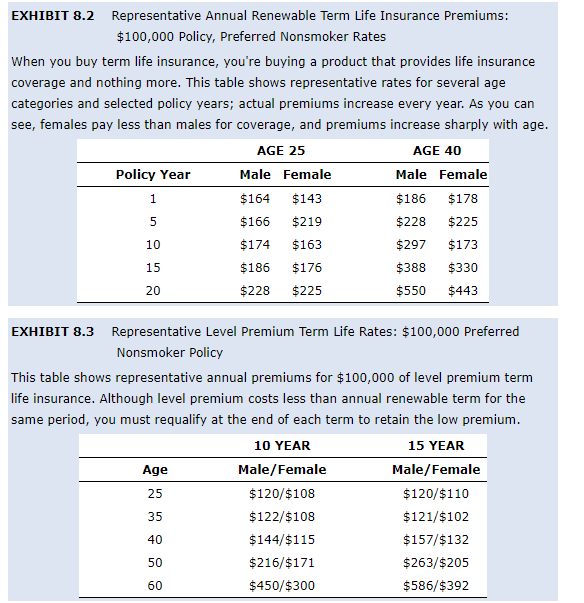

Costs for 5-year sustainable term can be level for 5 years, then to a brand-new price reflecting the new age of the guaranteed, and so on every 5 years. Some longer term plans will assure that the premium will certainly not raise during the term; others don't make that guarantee, making it possible for the insurance coverage company to elevate the rate throughout the policy's term.

This means that the policy's proprietor can change it right into an irreversible sort of life insurance policy without additional proof of insurability. In a lot of kinds of term insurance, including home owners and car insurance, if you haven't had a claim under the policy by the time it runs out, you obtain no refund of the costs.

Guaranteed Term 100 Life Insurance

Some term life insurance consumers have actually been miserable at this result, so some insurance firms have actually created term life with a "return of costs" feature. a whole life policy option where extended term insurance is selected is called. The premiums for the insurance with this function are commonly dramatically more than for policies without it, and they typically call for that you maintain the policy in force to its term otherwise you waive the return of costs benefit

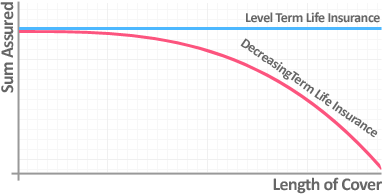

Level term life insurance policy premiums and death advantages remain consistent throughout the plan term. Degree term life insurance is normally extra inexpensive as it doesn't construct cash worth.

Dependable Joint Term Life Insurance

While the names often are made use of interchangeably, degree term insurance coverage has some important differences: the premium and survivor benefit remain the same for the duration of insurance coverage. Degree term is a life insurance policy policy where the life insurance premium and death advantage stay the exact same throughout of insurance coverage.

Table of Contents

Latest Posts

Burial Expenses Insurance

Aarp Burial Life Insurance

Final Expense Fund

More

Latest Posts

Burial Expenses Insurance

Aarp Burial Life Insurance

Final Expense Fund