All Categories

Featured

Table of Contents

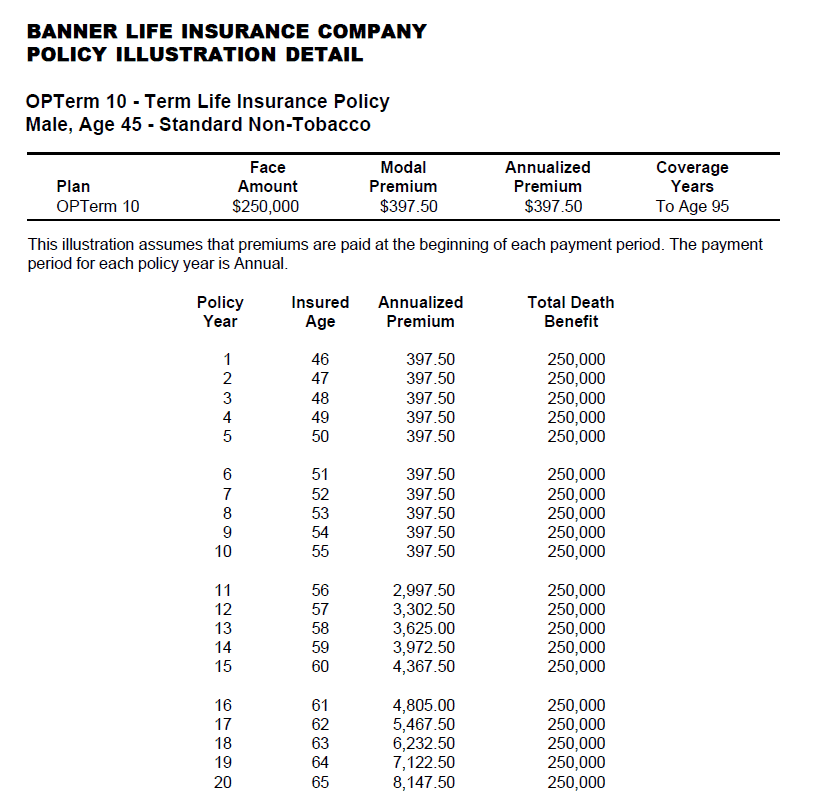

A degree term life insurance policy policy can offer you assurance that individuals that rely on you will have a survivor benefit during the years that you are intending to sustain them. It's a method to help care for them in the future, today. A level term life insurance policy (often called level premium term life insurance coverage) plan gives protection for a set variety of years (e.g., 10 or 20 years) while keeping the costs payments the same throughout of the plan.

With degree term insurance coverage, the price of the insurance will certainly remain the very same (or potentially reduce if returns are paid) over the regard to your plan, generally 10 or 20 years. Unlike permanent life insurance policy, which never runs out as lengthy as you pay costs, a level term life insurance policy policy will finish at some point in the future, usually at the end of the period of your level term.

What is Term Life Insurance Level Term? A Simple Explanation?

As a result of this, many individuals make use of long-term insurance coverage as a steady financial planning tool that can serve several needs. You might have the ability to convert some, or all, of your term insurance coverage during a set period, commonly the first one decade of your plan, without requiring to re-qualify for insurance coverage also if your health has actually changed.

As it does, you might desire to add to your insurance coverage in the future - Direct term life insurance meaning. As this occurs, you may want to ultimately decrease your fatality benefit or take into consideration transforming your term insurance coverage to an irreversible policy.

Long as you pay your costs, you can relax very easy recognizing that your loved ones will get a fatality advantage if you die throughout the term. Lots of term plans enable you the capacity to convert to permanent insurance without having to take another wellness test. This can enable you to capitalize on the additional benefits of a permanent plan.

Degree term life insurance coverage is one of the easiest courses right into life insurance policy, we'll discuss the benefits and disadvantages to make sure that you can pick a strategy to fit your requirements. Degree term life insurance policy is the most common and standard type of term life. When you're searching for short-term life insurance policy strategies, level term life insurance is one course that you can go.

You'll load out an application that includes basic individual details such as your name, age, etc as well as a much more thorough survey concerning your clinical history.

The brief answer is no., for example, allow you have the comfort of death benefits and can build up cash worth over time, implying you'll have extra control over your advantages while you're alive.

What is What Is Level Term Life Insurance? What You Need to Know?

Riders are optional arrangements included to your policy that can provide you added benefits and protections. Riders are a great way to include safeguards to your plan. Anything can occur throughout your life insurance policy term, and you wish to await anything. By paying just a bit more a month, riders can offer the support you require in case of an emergency situation.

There are circumstances where these advantages are developed into your plan, however they can also be available as a different addition that needs added payment.

Latest Posts

Burial Expenses Insurance

Aarp Burial Life Insurance

Final Expense Fund